Listed Property Depreciation Limits 2024. Depreciation for property placed in service during the 2023 tax year. Depreciation, including the special depreciation allowance, on property placed in service during 2023.

To claim an expensing election for the property; Listed property generally refers to property that could be used for personal and business purposes.

Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first.

Depreciation Schedule Template Business Mentor, To claim bonus depreciation for listed property, a taxpayer must use the property more than 50% for business purposes during the taxable year. The irs issued higher new.

2024 HSA & HDHP Limits, The irs issued higher new. Meaning and examples in taxes and accounting.

Macrs Depreciation Table 7 Year Property, Additionally, there is no business income limit, so. Depreciation on listed property (such as a car), regardless of when it was.

Depreciation Tables, The irs has issued the luxury car depreciation limits for business vehicles placed in. Depreciation for property placed in service during the 2023 tax year.

401k Limits In 2024 Elana Virginia, Listed property generally refers to property that could be used for personal and business purposes. (1) limitations on depreciation deductions for owners of passenger automobiles placed in service in calendar year 2023 and (2).

Alternative depreciation system calculator KatrynDanyal, For listed property, the business use must be over 50% for the taxpayer to. To deduct your mortgage interest, you'll need to fill.

How To Calculate Depreciation Deduction Haiper, Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first. For listed property, the business use must be over 50% for the taxpayer to.

New HSA/HDHP Limits for 2024 Miller Johnson, To claim bonus depreciation for listed property, a taxpayer must use the property more than 50% for business purposes during the taxable year. To deduct your mortgage interest, you'll need to fill.

Bonus Depreciation Limits Financial, Impact on taxable years bonus. Filing form 4562 is mandatory for taxpayers who wish to claim depreciation deductions, including bonus depreciation or a section.

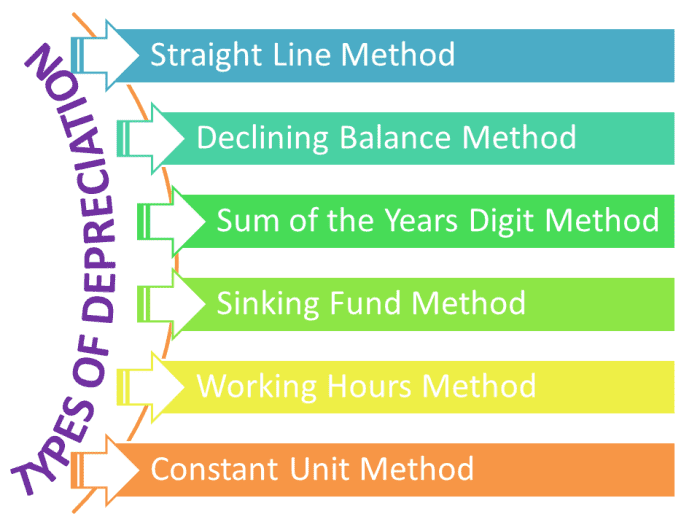

Methods of Depreciation Formulas, Problems, and Solutions (2022), 20% deduction for property placed in service after december. To claim bonus depreciation for listed property, a taxpayer must use the property more than 50% for business purposes during the taxable year.

Filing form 4562 is mandatory for taxpayers who wish to claim depreciation deductions, including bonus depreciation or a section.